In 2009, bitcoin inventor Satoshi Nakomoto argued that it was “a system for electronic transactions without relying on trust.”

That’s not true, according to today’s CITP’s speaker Kevin Werbach (@kwerb), a professor of Legal Studies and Business Ethics at the Wharton School at UPenn. Kevin is author of a new book with MIT Press, The Blockchain and the New Architecture of Trust.

A world-renowned expert on emerging technology, Kevin examines business and policy implications of developments such as broadband, big data, gamification, and blockchain. Kevin served on the Obama Administration’s Presidential Transition Team, founded the Supernova Group (a technology conference and consulting firm) and helped develop the U.S. approach to internet policy during the Clinton Administration.

Blockchain does actually rely on trust, says Kevin. He tells us the story of the cryptocurrency exchange QuadrigaCX, who claimed that millions of dollars in cryptocurrency were lost when their CEO passed away. While whole story was more complex, Kevin says, it reveals how much bitcoin transactions rely on many kinds of trust.

Rather than removing the need for trust, blockchain offers a new architecture of trust compared to previous models. Peer to peer trust is based on personal relationships. Leviathan trust, described by Hobbes, is a social contract with the state, which then has the power to enforce private agreements between people. The power of the state makes us more trusting in the private relationships– if you trust the state and if the legal system works. Intermediary trust involves a central entity that manages transactions between people

Blockchain is a new kind of trust, says Kevin. With blockchain trust, you can trust the ledger without (so it seems) trusting any actor to validate it. For this to work, transactions need to be very hard to change without central control – if anyone had the power to make changes, you would have to trust them.

Why would anyone value the blockchain? Blockchain minimizes the need for certain kinds of trust: removing single points of failure, reducing risks of monopoly, and reduces friction from the intermediation. Blockchain also expands trust by minimizing reconciliation, carries out automated execution, and increases the auditability of records.

What could possibly go wrong? Even if the blockchain ledger is auditable and trustworthy, the transaction record isn’t the whole system. Kevin points out that 80% of all bitcoin users rely on centralized key storage. He also reported figures that 20-80% of all Initial Coin Offerings were fraudulent.

Kevin tells us about “Vlad’s conundrum”- there’s a direct conflict between the design of the blockchain system and any regulatory model. The blockchain doesn’t know the difference between transactions, and there’s no entity that can say “no, that’s not okay.” Kevin tells us about the use of the blockchain for money laundering and financing terrorism. He also tells us about the challenge of moderating child pornography data that has been distributed across the blockchain- exposing every bitcoin node to legal risks.

None of these risks are as simple as they seem. Legal enforcement is carried out by humans who often consider intent. Simply possessing digital bits that represent child pornography data will not doom bitcoin. Furthermore, systems are less decentralized or anonymous than they appear. Regulations about parts of the system at the edges and endpoints of the blockchain can promote trust and innovation. Regulators have often been able to pull systems apart, find the involved parties, and hold actors accountable.

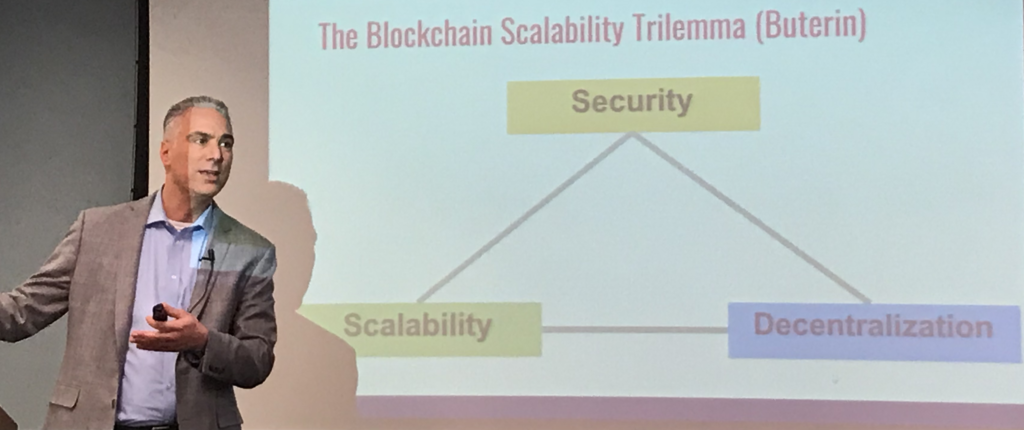

Kevin argues that designers of blockchain systems have to manage three trade-offs. Trust, freedom of action, and convenience. Any designer of a system will have to make hard choices about the tradeoffs among each of these factors.

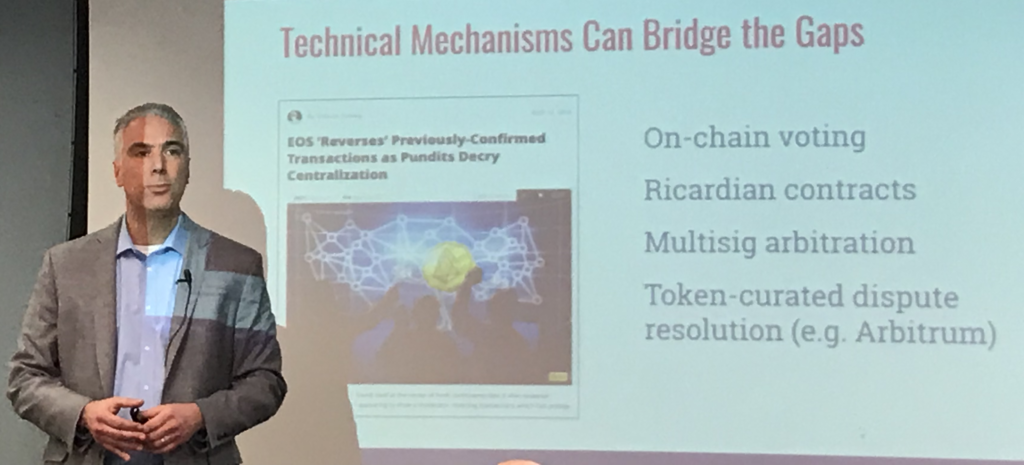

aCiting Vili Lehdonvirta’s blockchain paradox, Kevin tells us several stories about ways that centralized governance processes managed serious problems and fraud in blockchain systems that would have been problems if governance had purely been decentralized. Kevin also describes technical mechanisms for governance: voting systems, special kinds of contracts, arbitration schemes, and dispute resolution processes

Overall, Kevin tells us that blockchain governance comes back to trust– which shapes how we act with confidence in circumstances of uncertainty and vulnerability.