How could we create “a digital equivalent to cash, something that could be created but not forged, exchanged but not copied, and which reveals nothing about its users”?

Why would we need this digital currency?

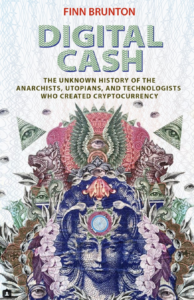

Dr. Finn Brunton, Associate Professor in the Department of Media, Culture, and Communication at NYU, discussed his new book Digital Cash: The Unknown History of the Anarchists, Utopians, and Technologists Who Created Cryptocurrency on November 19th, 2019 with CITP’s Technology and Society Reading Group. Footage aired on C-SPAN’s Book TV.

Through a series of “how” and “why” questions, Finn constructed a fascinating and critical narrative around the history of digital currencies and the emergence of modern cryptocurrency. How much currency should be produced? How do we know if currency is real? Why gold, relative to digital gold currencies (DGCs)?

Beginning with the $20 bill, as analog “beautiful objects of government technology” made possible in a digital era by the rose engine lathe, and ending with the first ever tweet about Bitcoin (“Running bitcoin”), posted by Hal Finney (@halfin), Finn described the unexpected sociotechnical origins of Bitcoin and blockchain. His talk, and the book on which it was based, identify seminal articles (e.g. “The Computers of Tomorrow” by Martin Greenberger) and discussion communities (e.g. Extropy), key figures from David Chaum and Paul Armer to Tim May and Phil Salin, and digital currencies, from EFTs to hashcash, that served as stepping stones toward contemporary cryptocurrencies. Yet, Finn also importantly acknowledged that while names and dates are memorable and compelling in constructing a timeline and pulling continuous threads through this history, there are “n+1” ideas about and versions of digital currency.

In this sense, Finn provides, more so than an attempt at a comprehensive chronology, a sense of the recurring objectives that motivated the evolution of cryptocurrency: trust in value, exchangeability, multiplicity, reproducibility, decentralization, abundance, scalability, sovereignty, verification, authenticity, fungibility, and transparency. In addition to these many, often “fundamentally conflicting,” values and objectives, very real concerns about privacy, surveillance, coercion, power asymmetries, and libertarian fears of crises and “the coming emergencies” led individuals and communities to develop their own digital currencies. Finn also identified some of the problematic narratives around digital currencies, such as the assertion that cryptocurrency is “as real as math”, and real challenges that have stymied and limited various experimental currencies.

Many of these challenges were highly apparent as Finn described the rise and fall of DGCs. The strange union between futuristic digital currency and precious metals, particularly gold in its “magnificent, stupid honesty,” emerged in many parallel libertarian communities in the US and around the world, as digital and analog receipts of ownership in precious metals were distributed to document remote stored value in a decentralized system. Finn explained how these DGCs (e.g. “eLiberty Dollars” or “The Second Amendment Dollar”) challenged the power and authority of state currencies and modern banking and how the abrupt seizure of precious metal stockpiles, as evidence, by Federal Marshals foreshadowed some of the inaccessibility problems of cryptocurrency, as well as the relationships between illicit activities and digital currencies which now exist on the Silk Road.

Finn ended the discussion answering audience questions, including about power dynamics and the libertarian origins of cryptocurrency. His assertion that money and crisis are linked, not only in the “economy of emergency preparedness,” but also in key points of progress toward “the future of money” is compelling in identifying how digital currencies fit into this historical pattern in a larger monetary history.